are nursing home expenses tax deductible in canada

Generally you can claim the entire amount you paid for care at any of the following facilities. You may be able to deduct nursing home costs for yourself your spouse or a dependent if you itemize deductions on your tax return.

Tax Deductions Caregivers Might Not Know About Agingcare Com

Dietician and chef wages.

. Home Care Expenses that Are Tax Deductible. This can include the part of the nursing home fees paid for full-time care that relate only to salaries and wages. Salaries and wages for attendant care given in Canada.

Based on the above statement. Only costs in excess of 75 of your. METC claims depend on.

When OHIP does not automatically cover a stay in a nursing home. Group homes in Canada. The good news is that the taxpayer secured a deduction for the full cost of the services of the caregivers.

Are home health care expenses tax-deductible in Canada. Tips for Successful Deductions. The following costs are tax deductible.

The Medical Expense Tax Credit METC can be claimed for costs associated with nursing and retirement homes that are paid by you or your spouse. The total of the eligible expenses is 8893. You may be able to deduct nursing home costs for yourself your spouse or a dependent if you itemize deductions on your tax return.

There are several types of caregiving expenses that you. As mentioned before medical expenses are claimed as tax-deductible based on the salary and wages of professional. Should he receive medical care while residing in the home you can claim those costs as a deductible expense along with any nursing services that might be provided.

Yes in certain instances nursing home expenses are deductible medical expenses. If you your spouse or your dependent is in a nursing home primarily for medical. Only costs in excess of 75 of your.

The Canada Revenue Agency CRA has commented that all regular fees paid to a nursing home including food accommodation nursing care administration maintenance and social. Costs for memory care assisted living and other arrangements are only partly deductible to the extent that they cover actual nursing services. The size of your METC will depend on your eligible expenses your net income for the tax year and the.

This can include the part of the nursing home fees paid for full-time care that relate only to salaries and wages. Group homes in Canada. They include mortgage interest insurance utilities repairs maintenance.

Nursing home costs are tax deductible if the primary reason for residence in a nursing home is to receive medical care. Salaries and wages for attendant care given in Canada. If you need laser eye surgery to correct your vision it represents a tax deductible expense.

But not all taxpayers are so lucky. Yes in certain instances nursing home expenses are deductible medical expenses. Housekeeping and laundry wages.

Stephens eligible expenses include. You can claim these expenses if youre a caregiver for a close relative. There are certain expenses taxpayers can deduct.

Are nursing home expenses tax deductible in canada. It is non-refundable but may be subtracted from the taxes you owe. Retirement homes homes for seniors or other institutions that.

What house expenses are tax deductible.

Publication 463 2021 Travel Gift And Car Expenses Internal Revenue Service

Medical Expenses Often Overlooked As Tax Deductions Cbc News

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

How Can I Reduce My Taxes In Canada

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

12 Ways Business Owners Can Save On Taxes Clover Blog

Babysitting Expenses Tax Guide For Parents

16 Amazing Tax Deductions For Independent Contractors Next

Did You Know Personal Health Insurance Premiums Are An Eligible Tax Deductible Expense In Ontario Ontario Blue Cross

16 Real Estate Tax Deductions For 2022 2022 Checklist Hurdlr

Turn Your Personal Medical Expenses Into 100 Corporate Expenses

Is There A Tax Deduction For Memory Care Facility Costs A Place For Mom

The Child Care Credit And Your Us Expat Tax Return When Abroad

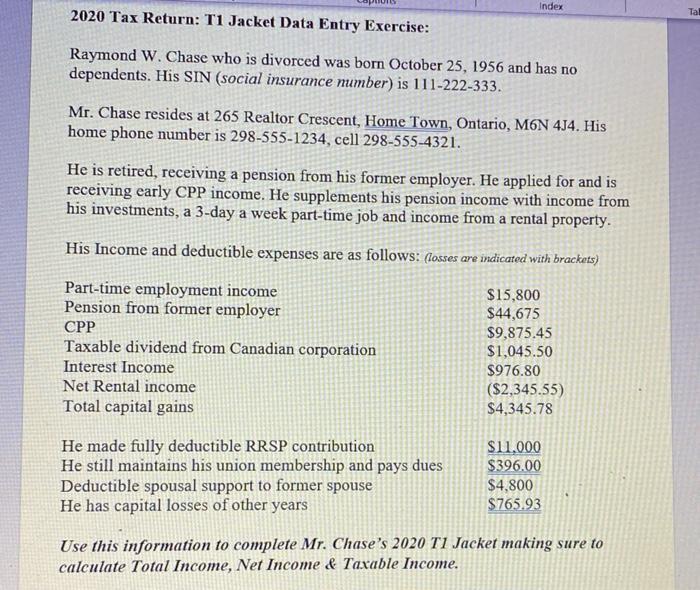

Solved This Is The Question Complete It On T1 Given Below Is Chegg Com

Expenses Related To Your Home Office Are Deductible Wolters Kluwer

What Are Elder Care Expenses Stowell Associates

Solved How To Solve This Thanks Child Care A Moving Expense Deduction Course Hero

:max_bytes(150000):strip_icc()/GettyImages-155158109-0035eac2c8b143db917f96755338684a.jpg)