south dakota sales tax rate 2021

Look up 2021 South Dakota sales tax rates in an easy to navigate table listed by county and city. 4 January 2021 Municipal Tax Guide South Dakota Department of Revenue Tax Application on Special Devices Special Jurisdictions Currently five Indian tribes in South Dakota have.

Sales Tax By State Is Saas Taxable Taxjar

With local taxes the.

. Get the benefit of tax research and calculation experts with Avalara AvaTax software. One field heading that incorporates the term Date. Exact tax amount may vary for different items.

Lowest sales tax 45 Highest sales tax 75 South Dakota Sales Tax. Detailed South Dakota state income tax rates and brackets are available on this. Municipal sales taxes to go unchanged.

The minimum combined 2022 sales tax rate for Yankton South Dakota is. This is the total of state county and city sales tax rates. This is the total of state county and city sales tax rates.

06-01-2021 1 minute read. Rate search goes back to 2005. 366 rows 2022 List of South Dakota Local Sales Tax Rates.

One field heading labeled Address2 used for additional address information. Free sales tax calculator tool to estimate total amounts. Business Frequently Asked Questions.

Look up 2022 sales tax rates for Eden South Dakota and surrounding areas. The minimum combined 2022 sales tax rate for Sioux Falls South Dakota is 65. Municipalities may impose a general municipal sales tax rate of up to 2.

Local tax rates in South Dakota range from 0 to 2 making the sales tax range in South Dakota 45 to 65. The South Dakota income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022. South Dakota has a 450 percent state sales tax rate a max local sales tax rate of 450 percent and an average combined state and.

Average Sales Tax With Local. What is the sales tax rate in Yankton South Dakota. Find information tax applications licensing instructions and municipal tax rates for the Sturgis Motorcycle Rally.

South Dakota also does not have a corporate income tax. What is the sales tax rate in Sturgis South Dakota. The minimum combined 2022 sales tax rate for Sturgis South Dakota is.

Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. All South Dakota municipal sales tax rates will remain the same on January 1 2021. This is the total of state county and city sales tax rates.

2022 South Dakota state sales tax. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the. 10-15-2020 0 minute read.

Beginning July 1 2021 four South Dakota communities will implement a new municipal tax rate. The South Dakota Department of Revenue administers these taxes. They may also impose a 1 municipal gross.

The base state sales tax rate in South Dakota is 45. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. Tax rates are provided by Avalara and updated monthly.

Municipal governments in South Dakota are also allowed to collect a local-option sales tax that. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. The South Dakota sales tax rate is currently 45.

South Dakota has a statewide sales tax rate of 45 which has been in place since 1933. The municipal tax changes taking effect. Find your South Dakota.

31 rows The state sales tax rate in South Dakota is 4500.

Sales Use Tax South Dakota Department Of Revenue

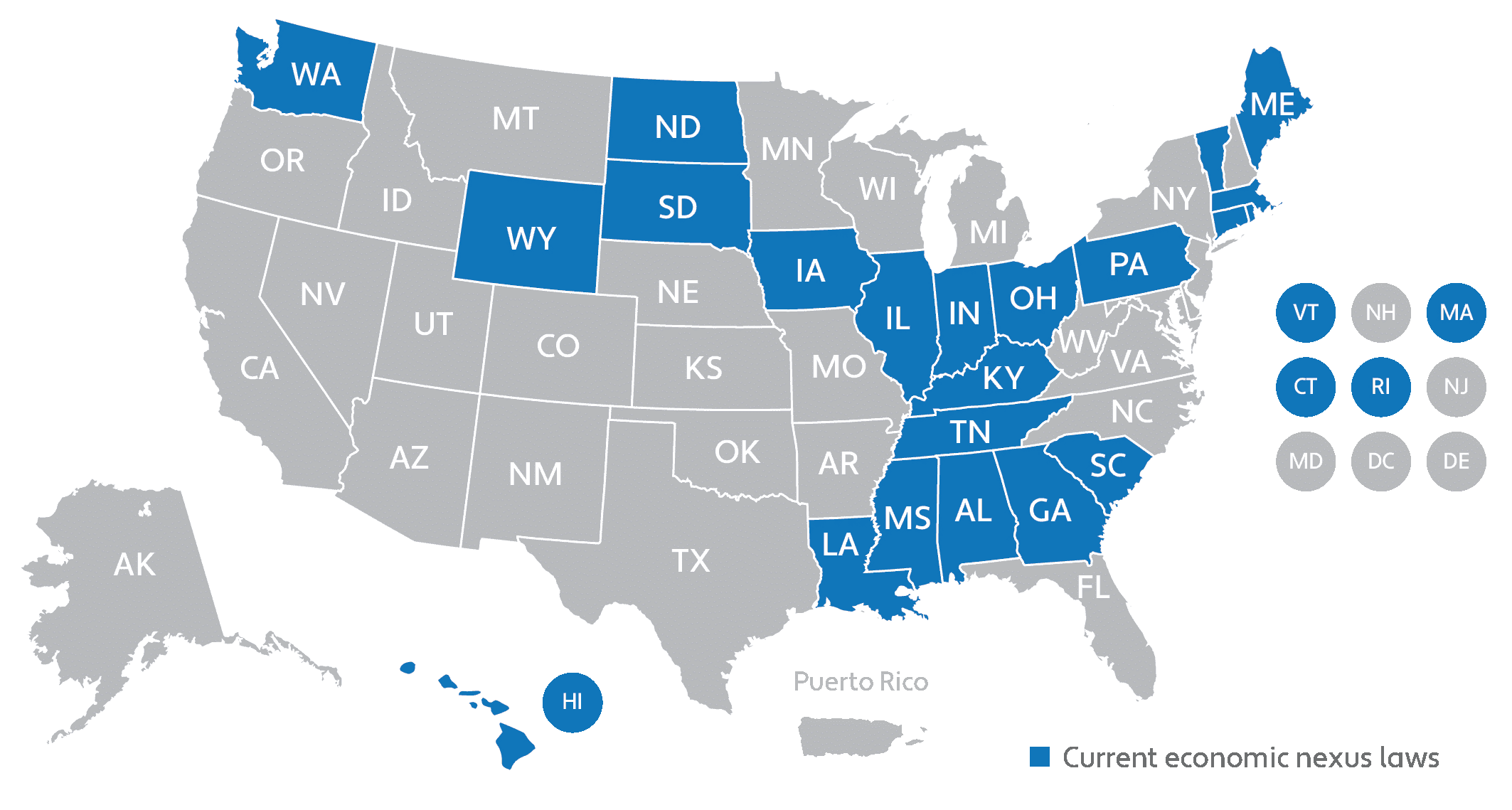

Redefining Online Sales Tax South Dakota Vs Wayfair And New Tax Compliance

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Sales Taxes In The United States Wikipedia

South Dakota Turned Itself Into A Tax Haven But Why

Sales Use Tax South Dakota Department Of Revenue

Are There Any States With No Property Tax In 2022 Free Investor Guide

States With No Income Tax Explained Dakotapost

Ohio Sales Tax Guide For Businesses

States With The Highest Lowest Tax Rates

Welcome To The North Dakota Office Of State Tax Commissioner

States With The Highest Lowest Tax Rates

Corporate Income Taxes Urban Institute

State Income Tax Rates Highest Lowest 2021 Changes

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

South Dakota Income Tax Calculator Smartasset

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities